food tax calculator pa

5 GST on food services provided by restaurants both air-conditioned and non ac. 205 x 01025 210125.

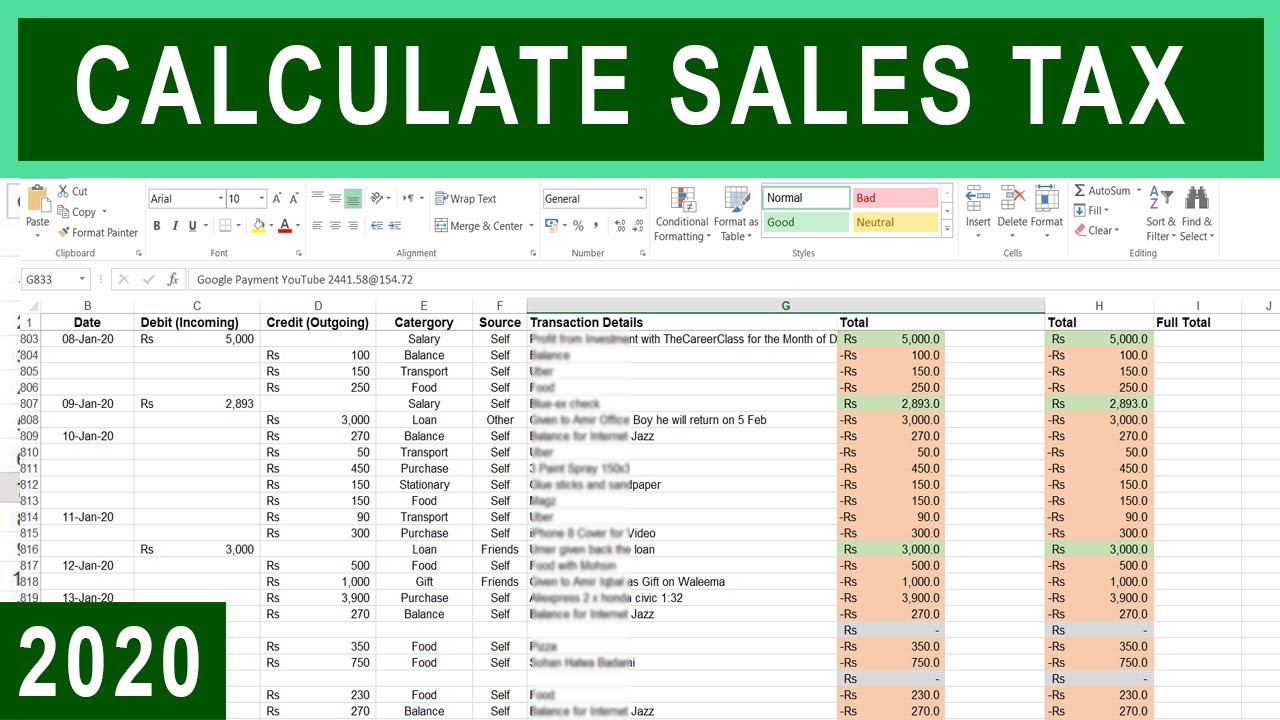

How To Calculate Sales Tax In Excel Tutorial Youtube

B Three states levy mandatory statewide local add-on sales taxes.

. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The Pennsylvania sales tax rate is 6 percent. You are able to use our Pennsylvania State Tax Calculator to calculate your total tax costs in the tax year 202122.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8. Sales Tax Amount Net Price x Sales Tax Percentage 100 Total Price Net Price Sales Tax Amount. Shared Bill Tip Calculator.

Candy and gumThe term candy refers to all types of preparations commonly referred to as candy including hard candy caramel chocolate candy licorice fudge cotton candy. Last updated November 27 2020. Find out more about the citys taxes on Chicagos government tax list.

Chicago Restaurant Tax. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax. Designed for mobile and desktop clients.

A calculator to quickly and easily determine the tip sales tax and other details for a bill. 6 percent state. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Use tax is the counterpart of the state and local sales taxes. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

In addition to these two state taxes Pennsylvania residents will also face local taxes on real estate sales and income. Total rate range 6080. Base state sales tax rate 6.

Details of the personal income tax rates used in the 2022 Pennsylvania State Calculator are published. When Pennsylvania sales tax is not charged by the seller on a taxable item or service delivered into or used in Pennsylvania the consumer is required by law to report and remit use tax to the Department of Revenue. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys tax of 125 Chicago the total tax Chicago-based restaurants face is 925.

15-20 depending on the distance total price etc. See the Retailers Information Guide REV-717 or the more detailed Taxability Lists for a taxable items to review subjectivity to sales tax of goods and. Then the amount of the sales tax is calculated as follows.

Simply enter the costprice and the sales tax percentage and the PA sales tax calculator will calculate the tax and the final price. By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. Pennsylvania has a 6 statewide sales tax rate but also has 69 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0122.

GST on Food Services. The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that includes the tip. Enter your info to see your take home pay.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. In order to receive food stamps in Pennsylvania your familys income before taxes must be below 130 percent of the poverty line. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Pennsylvania local counties cities and special taxation districts. Download state rate tables. We include these in their state sales.

The following words and terms when used in this section have the following meanings unless the context clearly indicates otherwise. The Pennsylvania Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Pennsylvania State Income Tax Rates and Thresholds in 2022. However certain products or services in Pennsylvania can have a higher or lower tax.

In the US a tip of 15 of the before tax meal price is typically expected. 5 GST on restaurant services including room service and takeaway provided by restaurants located within a hotel featuring room tariff less than Rs. You can change the default tax rate TAX Percentage in our calculator above if necessary.

Pennsylvania receives tax revenue from two primary sources. That value will then be added to the before-tax price to arrive at the after-tax price as follows. The following are the key rates applicable to GST on food services.

To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Sale and preparation of food and beverages. Determine your familys gross monthly income.

Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. 205 210125 2260125 which is rounded to 22601. The use tax rate is the same as the sales tax rate.

Use this app to split bills when dining with friends or to verify costs of an individual purchase. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes.

California 1 Utah 125 and Virginia 1. This page describes the taxability of food and meals in Pennsylvania including catering and grocery food. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

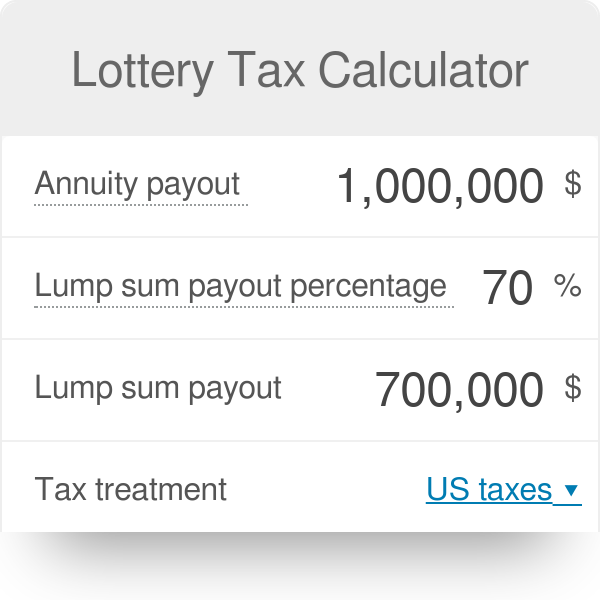

The PA sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. Pennsylvania state sales tax rate range. Please note state sales tax rate might change and the default sales.

Local rate range 020. Our sales tax calculator will calculate the amount of tax due on a transaction. A statewide income tax of 307 and a statewide sales tax of 6.

Get a quick rate range. The 6 percent sales tax is the most common tax percent for products and services in Pennsylvania. Pennsylvania Salary Calculator for 2022.

The calculator can also find the amount of tax included in a gross purchase amount. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Daily Design Challenge 004 Tax Calculator Design Challenges Calculator Design Design

Vintage Snow Flake Axle Grease Can With Handle Ebay In 2022 Axle Grease Ebay

Hello Kitty Calculator Hello Kitty Rooms Hello Kitty Hello Kitty Aesthetic

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Make Excel In Gst Or Tax Calculate Techno Surya Khatri Excel Blogger Resources Online Learning

This Important Question Often Gets Overlooked You Do Have Other Costs When Buying A House Mortgage Lenders All Requir Mortgage Payment Mortgage Home Mortgage

How To Consolidate Debt Ways To Get Debt Free De Consolidate De Debt Debtpayoff Free W Consolidate Credit Card Debt Debt Free Debt Relief Programs

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Llc Tax Calculator Definitive Small Business Tax Estimator

Gsd Code For Calculating Smv Charts And Graphs Study Methods Coding

Income Tax Rates In Nepal 2078 2079 Corporation Individual And Couple

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Berks County Property Tax Calculator Jeffreyhoguerealtor Com Berks County Property Tax Real Estate Information

Cukai Pendapatan How To File Income Tax In Malaysia

Pennsylvania Sales Tax Small Business Guide Truic

Finances Saving Economy Concept Female Accountant Or Banker Use Calculator Pa 1000 Modern 1000 Finance Saving Finance Healthcare Careers